capital gains tax increase 2021 retroactive

Donors will be able to give gifts without realization if the estate provisions take effect after 2021 the. JD CPA PFS.

Are You Ready To Talk Tax Join Us Live 3pm Az At The Tax Goddess Facebook Page For Our Live Q A Session With Shauna The Tax Goddes Tax Questions Cpa Business

A Retroactive Tax Increase.

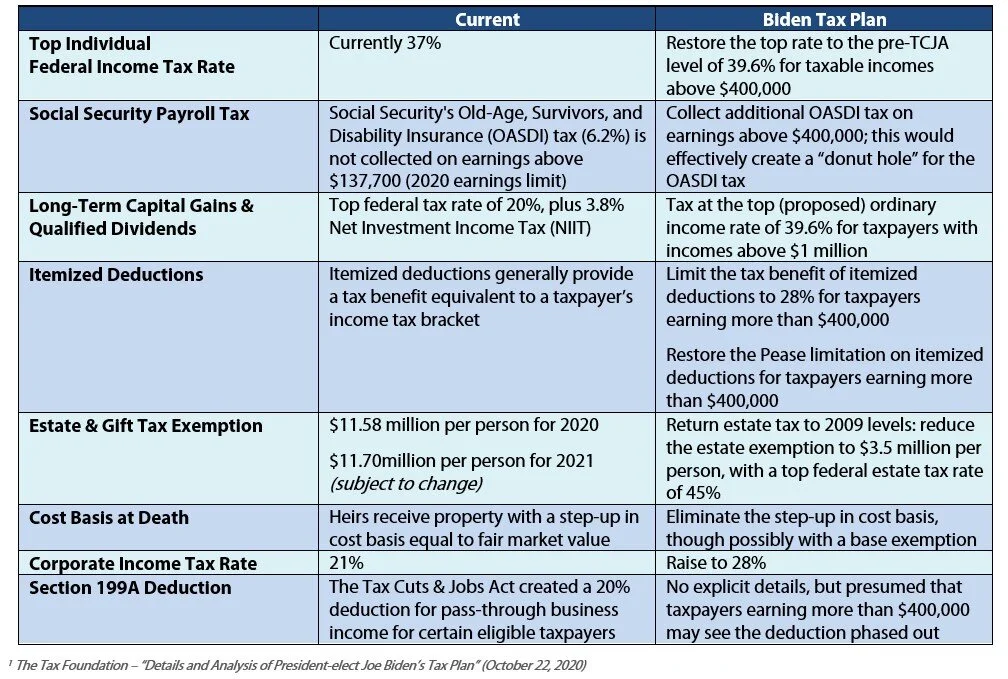

. Top earners may pay up to 434 on long-term. The Greenbook proposal sets out long-term capital gains and qualified dividends of taxpayers with adjusted gross income AGI of more than US1 million US500000 for married filing separately would be taxed at ordinary income tax rates see the above paragraph with 37 percent generally being the highest rate through 2025 408 percent. This may be why the White House is seeking an April 2021 effective date for the retroactive capital gains tax increase as President.

The bank said razor-thin majorities in the House and Senate would make a big increase difficult. Versions of this article were published by Advisor Perspectives and. It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains retroactive to April 2021.

Revenue Effects of President Bidens Capital Gains Tax. My guess is that since the Democratic majority is so thin there is little chance any tax increase will be made retroactive to January 1 2021. Whether or not the capital gains tax increase is retroactive the effects on investing and tax planning could be dramatic.

Positive amounts indicate revenue increase AIDS CREDITS. Bidens pre-election proposal advocated almost doubling the top tax rate on capital gains from the current 20 or 238 including the. Under the retroactive date of announcement proposed in the Green Book that same business owner could net 126 million due to the proposed increase in the capital gains tax rate.

In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. President Bidens American Families Plan proposes increasing the tax rate on long-term. Put another way if Democrats enact a tax increase in the second half of 2021 how likely is it that the effective date of the tax increase will be January 1 2021.

The current estimate of that effective date ranges from October 15 2021 on the early. The effective date of any increase in the long-term capital gains tax rate. Treasury Secretary Janet Yellen suggested in remarks before a Senate panel that if Congress were to pass a capital-gains tax hike effective starting in April 2021.

I can shed some light on one of the most significant issues for many. June 9 2021 Bernie Kent JD CPA PFS It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains retroactive to April 2021. June 16 2021 1108 AM PDT.

My guess is that since the Democratic majority is so thin there is little chance any tax increase will be made retroactive to January 1 2021. But many were taken off guard by the. The most dramatic tax changes usually occur after a 180-administration change like the one we just experienced.

2 Proposed Biden Retroactive Capital Gains Tax National axpayers Union ondation Could Be Challenged on Constitutional Grounds levying a 10 percent surtax on high earners6 imposing a one-time 25 percent wealth tax7 and imposing an annual 2 percent or 3 percent wealth tax8 One idea in play is a retroactive capital gains tax increase raising the top tax rate currently 238. So its no surprise that President Biden is calling for significant capital gains increases for income above 1 million hoping to raise the capital gains rate at that level from 20 to 396. 2021 637 pm ET.

President Biden has proposed increasing the top 238 capital gain rate to 434 a staggering 82 increase. On the tax front the biggest surprise in Bidens proposal is that he assumes an increase in the capital gains rate would be retroactive. The later in the year that a.

This may be why the White House is seeking an April 2021 effective date for the retroactive capital gains tax increase as President Biden announced the proposal on April 28 2021 although it was not widely publicized at the time and investors are still becoming aware of it. TAX POLICY NON GENERAL FUND CHANGE ITEMS. The top rate for 2021 is 37 plus.

For taxpayers with income of over 1 million long-term capital gains will be taxed at ordinary rates. If the sale were to occur in 2022 at a 396 long-term capital gain rate that same business owner could net 1208 million. If this were to happen it may not only seem unfair but it is also bad tax policy.

Then there is timing. Biden wants to tax capital gains you made even before a bill passes. 2 TAX POLICY REVENUE1 47737661 54594416 58105887.

If the effective date is retroactive to April 2021 it will be too late for investors to sell to avoid the tax increase. Positive amounts indicate expenditure Actual Conference Target LINE ITEM FY 2021-22 FY 2022-23 FY 2024-25 1 GENERAL FUND FORECAST. The later in the year that a Democratic tax bill if any is passed the less likely it will have any retroactive effect.

This resulted in a 60 increase in the capital gains tax collected in 1986. President Joe Biden released his proposed 2022 fiscal year budget on Friday which calls for an increase of the top capital gains tax rate to 396.

2021 Tax Changes Biden S High Income Families Income Capital Gains Taxes Proposal

Private Equity Faces Increase In Capital Gains Tax Rate Our Insights Plante Moran

Will Joe Biden S Proposed Taxes On Capital Make America An Outlier The Economist

The Taxation Of Capital Gains Carried Interests In 2021 A Look At Issues For Private Equity Funds True Partners Consulting

Proposed Impactful Tax Law Changes And What You Can Do Now Johnson Pope Bokor Ruppel Burns Llp

Managing Tax Rate Uncertainty Russell Investments

Tax Proposals Under The Build Back Better Act Version 2 0

Tax Moves To Make Before Year End Barron S

Tax Increases Are Coming Or Are They Bny Mellon Wealth Management

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Impact Of Green Book Capital Gains Proposals On Loss Harvesting Strategies Aperio

A Closer Look At 2021 Proposed Tax Changes Charlotte Business Journal

House Democrats Propose Hiking Capital Gains Tax To 28 8

Managing Tax Rate Uncertainty Russell Investments

2021 Tax Changes Biden S High Income Families Income Capital Gains Taxes Proposal

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

Retroactive Effective Date For Capital Gains Tax Increase Is A Bad Idea

Tax Reform Uncertainty Leaves Taxpayers With Questions Fi3 Advisors

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others